Credit Improvement Watch

There are no dead deals with borrower intelligence

Boost your loan volume and contact your borrower the moment their credit score improves.

"Credit alerts are the most rewarding ROI that Sales Boomerang has to offer."

Steve Grossman

NJ Lenders

Be there for your borrowers at the right time.

Poor credit is responsible for almost 50% of all mortgage related turndowns. Up to 30% of your turndowns will fix their credit within 12 months and go to your competitor for a loan. Don't lose those deals. Get notified when your borrower has fixed his credit and deliver the best news anyone could ever hear.

Customers For Life

With this alert, you can turn every customer into a Customer For Life. No matter what their credit situation, make your customer feel secure that they are in good hands.

More Loans

Get notified when your customer has fixed his credit, increasing your loan volume while putting a smile on a customer's face.

Ultimate Deal Saver

Your referral partners will LOVE YOU because you can add 20 to 30% lift to their production every single year. Now you can be the referral source to your realtor partners.

Truly supporting No Borrower Left Behind.

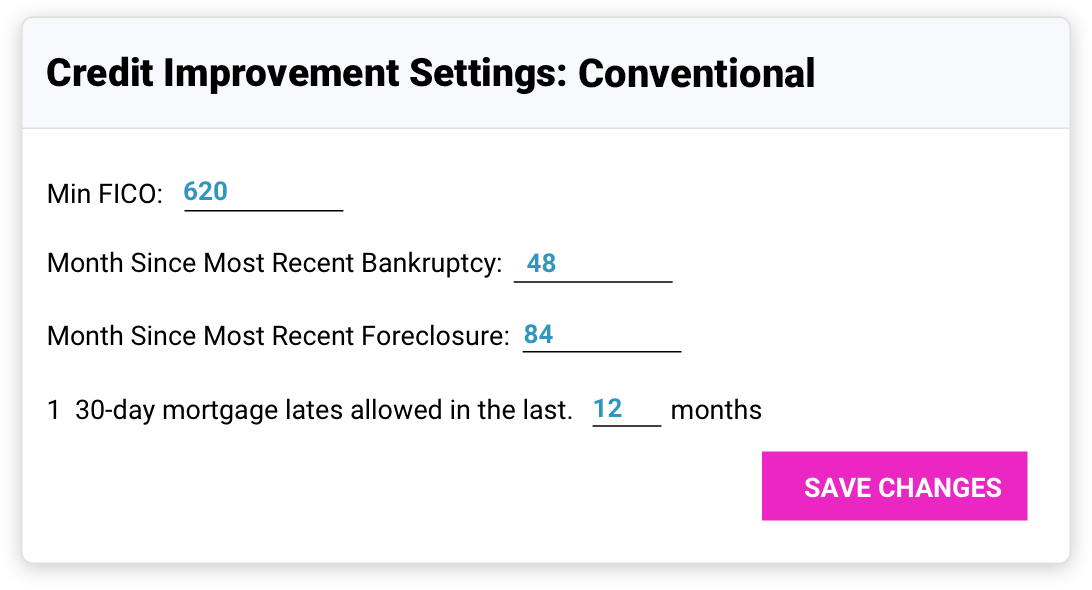

We'll notify you when your targets are reached.

Fully customizable by loan type to meet your goals.

Sales Boomerang drives revenue in any market!

The fastest, most accurate information helps you dominate your competition.

Time-Sensitive Borrower Activity

Act fast to maximize conversion or risk losing your customer forever.

Non-Credit Alerts

Secure borrowers in market, and gain early insight into potential loan needs.

Core Credit Alerts

Retain/grow your database with credit-qualified insight into loan needs.

Servicing Portfolio Monitoring

Retain your serviced loans.

Prescriptive Scenarios

Act on credit-qualified scenarios

with multiple loan-readiness signals.

Database Intelligence Reports

Optimize your targeting and defensive marketing.