EPO Watch

Do you like paying back commissions?

The more EPOs you get the higher the chance of your top producer leaving

"Sales Boomerang converts just as well as inbound phone calls we receive. I have loan officers that only work Sales Boomerang leads, and my ROI is in the 20-30X Range. My expectation now is that 10% of my $275M monthly loan volume comes from Sales Boomerang."

John Kresevic

JFQ Lending

Eliminate early payoff penalties.

What does a world without EPOs look like for you? Just one EPO can cost a lender between $10,000-$16,000 when a borrower pays off their existing loan before it has seasoned. A lender with 45,000 borrowers in their database has an average of 17 EPOs per month. That’s $195,500 per month. Save your bottom line! Get notified the moment a borrower may have an EPO.

Ultimate Defense

EPO Prevention Watch is a must have for lending companies. Often knowing that a borrower is going to refinance is enough to start the conversation with the borrower that prevents an EPO.

Win Again

It gives the LO an opportunity to win back the loan and lock in rates for 30-60 days so the borrower can get the value they are looking for without incurring penalties against the loan company.

Always Prepared

Most of the time, lenders have no idea that their past client is in the market until the borrower's new lender is ordering a payoff request. At that point, it is too late, incurring penalties against the loan company.

EPO Prevention Watch

Early Warning System

Get notified when to engage with past clients before they order a payoff request.

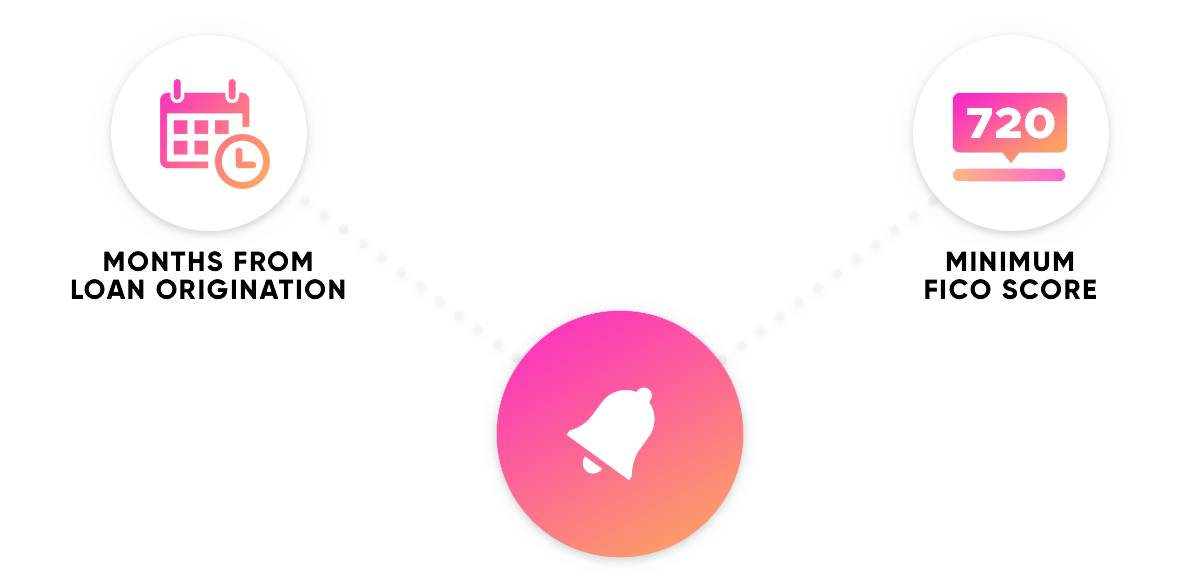

100% Customized

Set the criteria that meet your business needs: months from the loan origination, and minimum FICO score. The system will notify you as soon as a borrower triggers the alert.

Portfolio Saver

When rates go down, borrower start shopping, leaving you vulnerable to portfolio runoff. High credit borrowers refinance from an FHA loan to a conventional loan to lower their rate and drop their mortgage insurance. These are the very borrowers that you need to retain to keep up the overall credit quality in your portfolios.

Sales Boomerang drives revenue in any market!

The fastest, most accurate information helps you dominate your competition.

Time-Sensitive Borrower Activity

Act fast to maximize conversion or risk losing your customer forever.

Non-Credit Alerts

Secure borrowers in market, and gain early insight into potential loan needs.

Core Credit Alerts

Retain/grow your database with credit-qualified insight into loan needs.

Servicing Portfolio Monitoring

Retain your serviced loans.

Prescriptive Scenarios

Act on credit-qualified scenarios

with multiple loan-readiness signals.

Database Intelligence Reports

Optimize your targeting and defensive marketing.